![]()

WHAT IS THE FUND?

The Miller Investment Fund owns a diverse portfolio of investment properties. This open-ended real estate investment Fund allows investors to contribute either capital or buildings in exchange for units. Our purpose is to deliver consistent and resilient returns to long term property owners and investors from an actively managed, high-quality, diverse portfolio located in target markets.

![]()

OUR STORY

Founded in 1920, Miller Diversified began as a family agricultural business that has evolved over time into a multifaceted, full-service real estate company. Throughout its history, Miller Diversified has dedicated itself to providing a steady, conservative, innovative investment approach with the highest level of integrity and transparency. Miller Diversified sponsored the launch of the Miller Investment Fund, LLC in July 2018.

Target Property Types

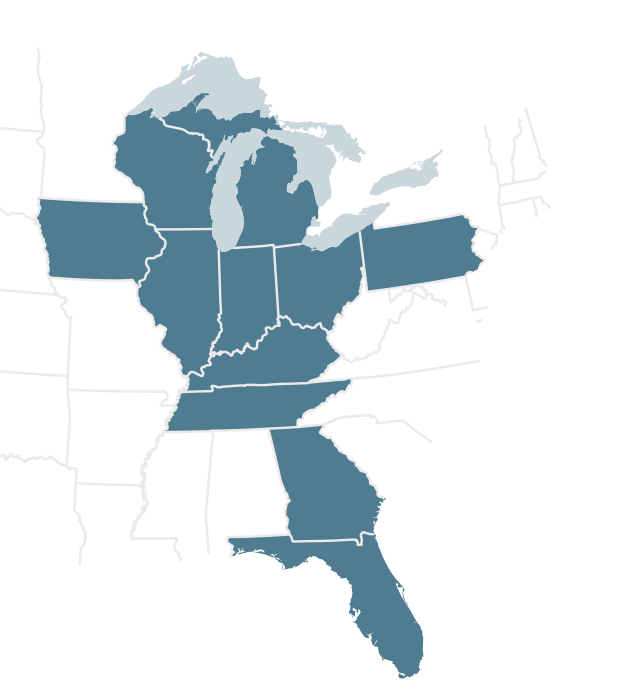

A Peek At Our Ideal Fund Property Locations

We are searching for markets with solid economic fundamentals located within the expanded Midwest, as shown here. We’re focused on attracting productive, income-producing properties across these market segments:

+ Retail

+ Commercial Office

+ Medical Facilities

+ Light Industrial

+ Warehouse

+ Multifamily

Fund Benefits

Why choose the Fund?

How To Get Involved

Contribute Capital Or Buildings

It’s that simple. We’ve created these two entry points to make the Fund accessible to both building owners and accredited investors. However, in order to do whatever we can to set the Fund up for success, we’ve crafted a very specific onboarding process for each pathway. Want to learn more?

PS: Wondering about the brainpower behind the Fund? Meet The Leadership >