The Fund Purpose

Deliver consistent and resilient returns to long term property owners and investors from an actively managed, high-quality, diverse portfolio located in target markets.

HISTORY

Founded in 1920, Miller Diversified began as a family agricultural business that has evolved over time into a multifaceted, full-service real estate company. Throughout its history, Miller Diversified has dedicated itself to providing a steady, conservative, innovative investment approach with the highest level of integrity and transparency. Miller Diversified sponsored the launch of the Miller Investment Fund, LLC in July 2018.

Fund Benefits

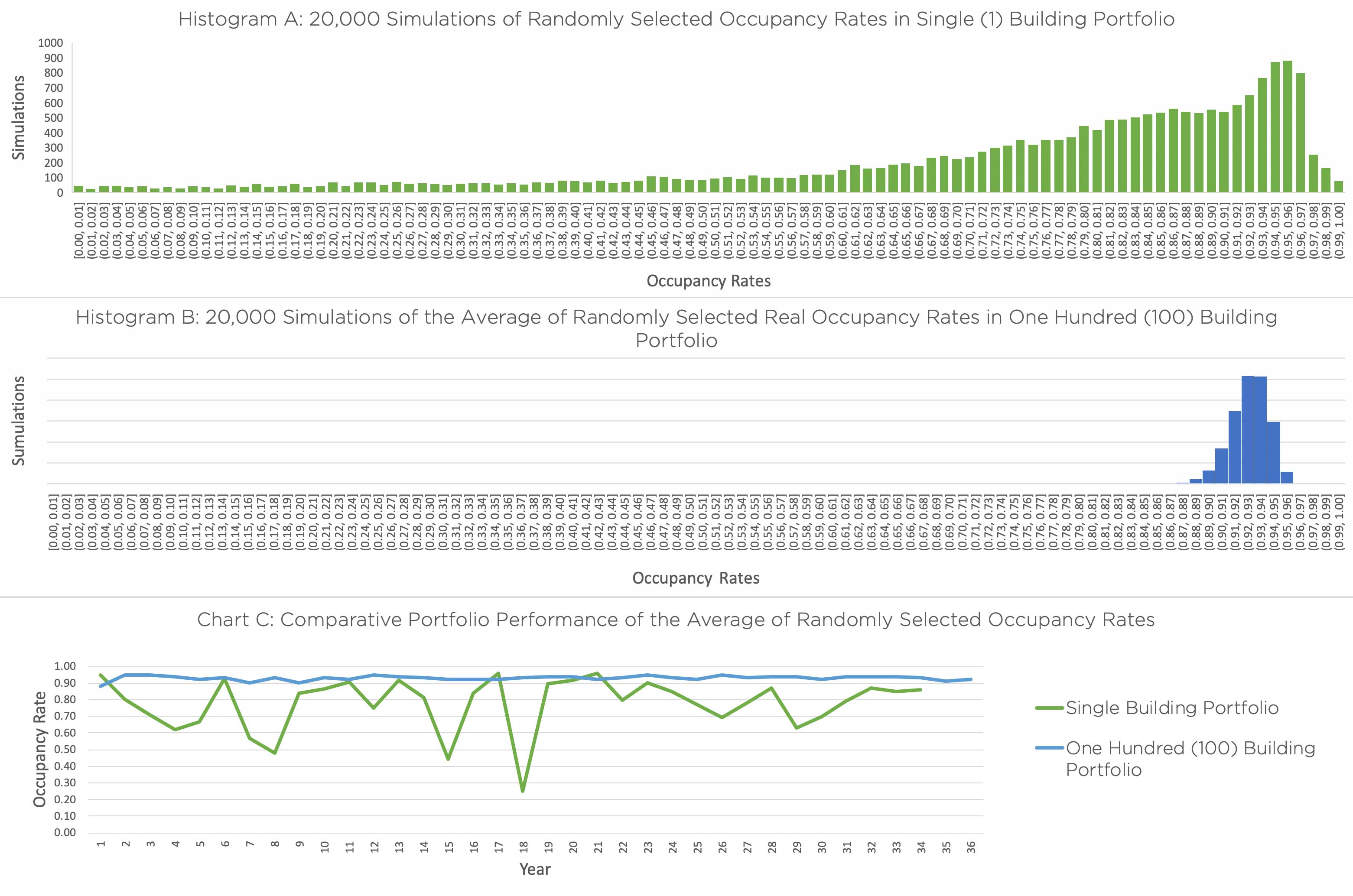

Diversification: Through its “co-op” like structure of properties, the Miller Investment Fund is able to reduce the volatility associated with single-building or single-tenant risk.

Enhanced Liquidity: While not as liquid as traded securities, the shares of the Miller Investment Fund offer more transferability without the need for complete liquidation of the underlying real estate assets.

Liability Reduction: The Miller Investment Fund offers investors the potential to eliminate personal debt guarantees associated with the ownership of individual buildings or even small portfolios.

Succession & Business Planning: Managed by real estate professionals, the Miller Investment Fund can offer solutions to the complex issues that arise in generational or partnerships transfers involving real estate.

Tax Planning: Through its structure involving multiple single-member LLCs for its property holdings, the Miller Investment Fund offers increased transaction flexibility for 1031 exchanges as well as other tax deferral strategies.

Target Markets

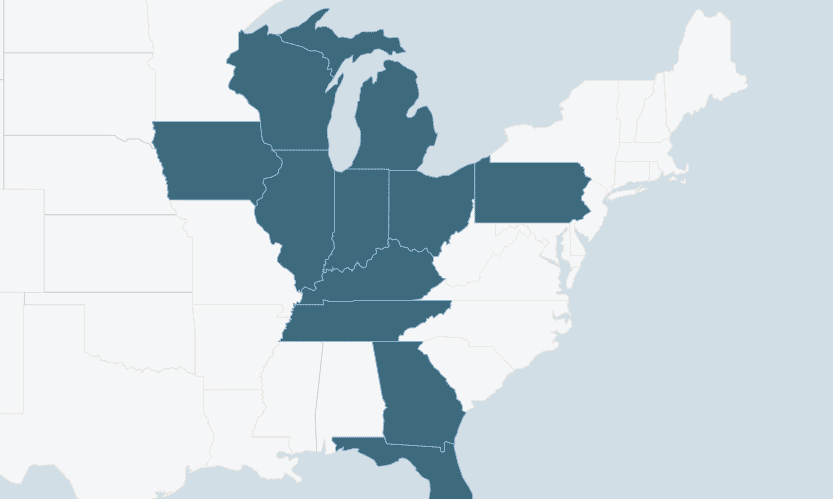

Markets with solid economic fundamentals located within the “expanded Midwest.”